The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium in 2018 will remain $134 (or higher, depending on your income). In 2017, most Medicare beneficiaries who received Social Security benefits paid a lower monthly premium ($109, on average). However, this is likely to change in 2018.

Due to a provision in the Social Security Act called the “hold harmless” rule, Medicare premiums for existing beneficiaries can’t increase faster than their Social Security benefits. Over the past few years, Social Security benefits didn’t increase much because of low or no cost-of-living increases. However, there will be a 2% cost-of-living increase for Social Security benefits in 2018. This increase will cause more people to pay higher monthly Medicare Part B premiums closer to the standard ($134) amount. The Social Security Administration (SSA) will tell you the exact amount of your Part B premium in 2018.

Approximately 30% of Medicare beneficiaries are not protected by the hold harmless rule, and may pay the standard premium or more for Medicare Part B. You fall into this group if:

- You enroll in Part B for the first time in 2018.

- You don’t get Social Security benefits.

- You’re directly billed for your Part B premiums (they aren’t taken out of your Social Security benefits).

- You have Medicare and Medicaid, and Medicaid pays your premiums.

- Your modified adjusted gross income, as reported on your federal income tax return from two years ago, is above a certain amount.*

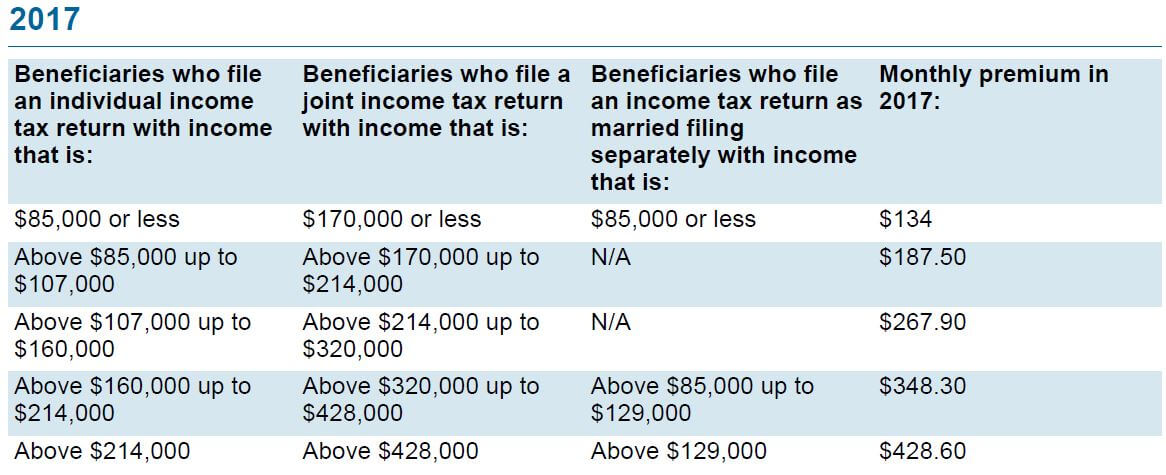

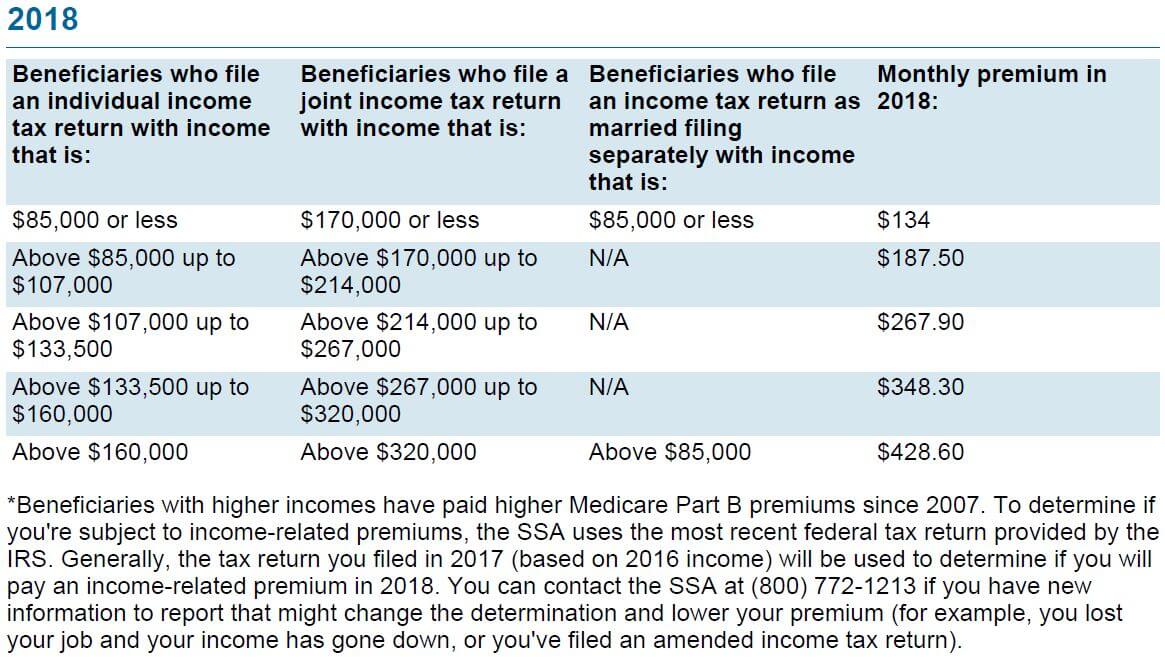

The tables below show the Part B premium that applies if you’re in this group.

Other Medicare costs

Other Medicare Part A and Part B costs in 2018 include the following:

- The annual Medicare Part B deductible for Original Medicare will be $183, the same as in 2017.

- The monthly Medicare Part A (hospital insurance) premium for those who need to buy coverage will cost up to $422, up from $413 in 2017. However, most people don’t pay a premium for Medicare Part A.

- The Medicare Part A deductible for inpatient hospitalization will be $1,340, up from $1,316 in 2017. Beneficiaries will pay an additional daily coinsurance amount of $335 for days 61 through 90, up from $329 in 2017, and $670 for stays beyond 90 days, up from $658 in 2017.

- Beneficiaries in skilled nursing facilities will pay a daily coinsurance amount of $167.50 for days 21 through 100 in a benefit period, up from $164.50 in 2017.

To view the Medicare fact sheet announcing these and other figures, visit medicare.gov.

Prepared by Broadridge Investor Communication Solutions, Inc. Copyright 2018

This blog is provided by Windward Private Wealth Management Inc. (“Windward” or the “Firm”) for informational purposes only. Investing involves the risk of loss and investors should be prepared to bear potential losses. No portion of this blog is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Certain information contained in the individual blog posts will be derived from sources that Windward believes to be reliable; however, the Firm does not guarantee the accuracy or timeliness of such information and assumes no liability for any resulting damages.

Windward is an SEC registered investment adviser. The Firm may only provide services in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about Windward’ registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov.