Taking Advantage of Market Volatility

The goal of opportunistic rebalancing is to capitalize on market fluctuations, while minimizing trading and income tax costs. Windward adopted this approach using research by Gobind Daryanani CFP® Ph.D.

The main reason for rebalancing is to maintain a portfolio’s target asset allocation. As time goes by and the market moves, some asset classes may perform better than others during a certain period of time, causing assets to drift away from the desired allocation. Rebalancing helps restore allocations of assets in a portfolio to their designed percentages so that the portfolio can achieve the balance between risk and reward and provide long-term benefits.

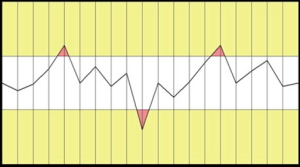

Opportunistic rebalancing is designed not only to control portfolio drift but also to capture buy-low/sell-high opportunities as asset class performances drift relative to each other. This approach helps to control portfolio risk, and may provide return improvement. If a portfolio remained unattended, it would stray over time away from the original target allocation to other points that are less efficient with higher risk or lower return, or both.As in the “opportunistic rebalancing” graph above, a rebalance band is expressed as a percentage of the original target allocation for each asset class. Suppose the allocation of an asset class is 60 percent. Rebalancing would be required only if the asset class drifted outside the rebalance range shown by the arrows above and below the band. An asset class that moves outside of the rebalancing range provides an opportunity to buy asset classes when they are underweighted and to sell when they are over-weighted.

Opportunistic rebalancing is designed not only to control portfolio drift but also to capture buy-low/sell-high opportunities as asset class performances drift relative to each other. This approach helps to control portfolio risk, and may provide return improvement. If a portfolio remained unattended, it would stray over time away from the original target allocation to other points that are less efficient with higher risk or lower return, or both.As in the “opportunistic rebalancing” graph above, a rebalance band is expressed as a percentage of the original target allocation for each asset class. Suppose the allocation of an asset class is 60 percent. Rebalancing would be required only if the asset class drifted outside the rebalance range shown by the arrows above and below the band. An asset class that moves outside of the rebalancing range provides an opportunity to buy asset classes when they are underweighted and to sell when they are over-weighted.

As in the “opportunistic rebalancing” graph above, a rebalance band is expressed as a percentage of the original target allocation for each asset class. Suppose the allocation of an asset class is 60 percent. Rebalancing would be required only if the asset class drifted outside the rebalance range shown by the arrows above and below the band. An asset class that moves outside of the rebalancing range provides an opportunity to buy asset classes when they are underweighted and to sell when they are over-weighted.

If a class is bought when it is lower than its target and the class then reverts, the return increases. The implicit assumption is that the underweighted class is also undervalued and reversion to the mean should imply that future returns are expected to be higher than past returns. The same is true if an asset class is sold when it is above the target and it reverts, your return also increases.

There are significant advantages of opportunistic rebalancing over traditional annual or quarterly rebalancing. Rebalancing opportunities occur sporadically and can only be captured if the portfolio is monitored frequently-as on a weekly or bi-weekly basis. Opportunistic rebalancing goes beyond simply controlling risk; it also may increase return benefits by capturing sporadic buy-low/sell-high opportunities.