Roth IRAs are popular retirement savings vehicles because distributions from them are tax-free. You can make a contribution to a Roth IRA if your income is below a certain level but another way to fund a Roth is to convert some or all of your IRA or retirement plan money to a Roth IRA.

Contributing to Roths

To add money to a Roth IRA you can either contribute directly, convert all or part of a traditional IRA to a Roth IRA, or you can roll funds over from an eligible employer retirement plan into a Roth.

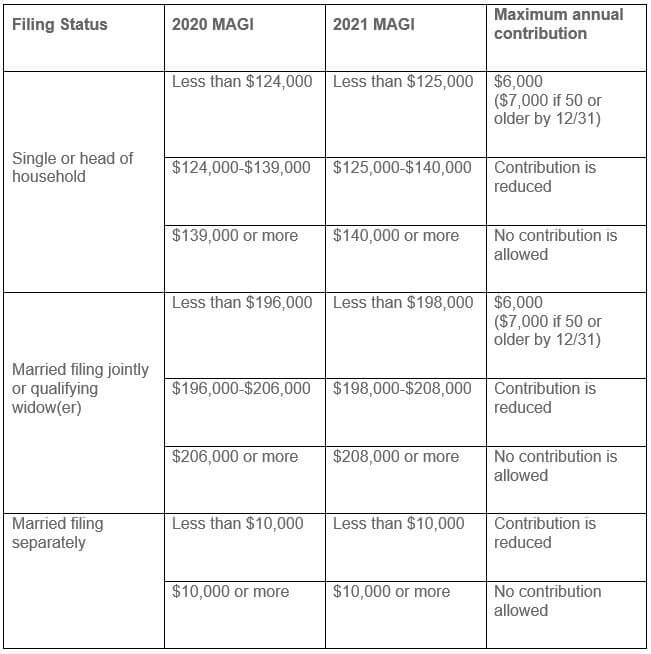

You may be limited on your ability to make annual contributions. This depends on your income level (“modified adjusted gross income” AKA MAGI), as shown in the chart below:

Unlike a traditional IRA, you can contribute to a Roth IRA even if you’re 72 or older. Your contributions generally can’t exceed your earned income for the year (special rules apply to spousal Roth IRAs).

Changes to Roth conversion rules

Prior to 2010, you couldn’t convert a traditional IRA to a Roth IRA (or roll over non-Roth funds from an employer plan to a Roth IRA) if your MAGI exceeded $100,000 or you were married and filed separate federal income tax returns. Tax Increase Prevention and Reconciliation Act (TIPRA) changed all of that in 2010. Now, regardless of your filing status or earnings, you can convert a traditional IRA to a Roth IRA. That’s right, no matter what your income level is, you can do a Roth conversion.

SEP IRAs and SIMPLE IRAs can also be converted to Roth IRAs. For SIMPLE IRAs, you’ll need to participate in the plan for two years before you convert. You’ll need to set up a new SEP/SIMPLE IRA to receive any additional plan contributions after you convert.

You can’t convert an inherited IRA to a Roth IRA. Special rules apply to spouses that are beneficiaries, but in general, the IRA must be yours to convert.

Conversion logistics

Notify your financial advisor or existing traditional IRA trustee or custodian that you want to convert all or part of your traditional IRA to a Roth IRA. There will likely be paperwork necessary to complete the transaction. You may need to open a new Roth IRA and then have the funds in your traditional IRA transferred directly to your new Roth IRA.

Alternatively, you can instead contact the trustee/custodian of your traditional IRA, have the funds in your traditional IRA distributed to you. Then you have sixty days to roll those funds over to your new Roth IRA as a conversion. The income tax consequences are the same regardless of the method you choose.

Tax effects of the conversion

When you convert a traditional IRA to a Roth IRA, you’re taxed as if you received a distribution. The only difference is that the 10% early distribution tax penalty won’t apply even if you’re under age 59½. If you make a nonqualified withdrawal from your Roth IRA within five years of your conversion, the IRS may recapture this penalty tax.

You can also roll over non-Roth funds from an employer plan (such as a 401(k)) to a Roth IRA. Like traditional IRA conversions, the amount you convert will be subject to income tax in the year of conversion (except for any after-tax contributions you’ve made).*

If you’ve made only after-tax nondeductible contributions to your traditional IRA, then only the earnings will be subject to tax at the time you convert the IRA to a Roth. Your nondeductible contributions into the IRA won’t be taxable upon conversion to Roth. If you’ve made both deductible and nondeductible contributions to your traditional IRA, and you don’t plan on converting the entire amount, things can get complicated. The amount you convert is deemed to be a pro rata portion of the taxable and nontaxable dollars in the IRA.

For example: assume that your traditional IRA contains $350,000 of taxable (deductible) contributions, $50,000 of nontaxable (nondeductible) contributions, and $100,000 of taxable earnings. You can’t convert the $50,000 nondeductible (nontaxable) contributions to a Roth and have a tax-free conversion. You need to prorate the taxable and nontaxable portions of the account. Using the example above, 90% ($450,000/$500,000) of each distribution from the IRA (including any conversion) will be taxable. The other 10% will not be taxable.

You can’t escape this rule by using separate IRAs. You must aggregate all of your traditional IRAs (including SEPs and SIMPLEs) when you calculate the taxable income resulting from a distribution from (or conversion of) any of the IRAs.

Some advisors suggest making a tax-free conversion by taking a total distribution from all of your traditional IRAs, rollover the taxable dollars to an employer plan like a 401(k) (assuming the plan accepts rollovers) and then convert the remaining balance (the nontaxable dollars) to a Roth IRA.

The IRS has not yet officially ruled on this, so be sure to get professional advice before considering this.

“Back door” Roth contributions

If your income exceeds the limits for making contributions to a Roth, one option is making nondeductible contributions to a traditional IRA (as long as you haven’t yet reached age 72) then convert that traditional IRA to a Roth. This is sometimes referred to as a “back door” Roth IRA.

There are no limits to the number of Roth conversions you can make. Just a reminder, you will need to aggregate all of your traditional IRAs — including SEPs and SIMPLEs — when you calculate the taxable portion of the conversion.

Is a Roth conversion right for you?

The answer to this question depends on many factors. Your current and projected income tax rates, the length of time you can leave the funds in the Roth IRA without needing withdrawals, your state’s tax laws, and how you’ll pay the income taxes due at the time of the conversion are all considerations. We recommend getting professional advice on whether a Roth conversion is right for you. Feel free to contact us to ask!

*When it comes to employer plans, there may be several distribution options available to you. You can roll over both Roth and non-Roth 401(k) plan assets to a Roth IRA, but you can also leave the savings in your former employer’s plan, if allowed, you can transfer assets to a new employer’s plan, if allowed, or you can take the distribution in cash.

This blog is provided by Windward Private Wealth Management Inc. (“Windward” or the “Firm”) for informational purposes only. Investing involves the risk of loss and investors should be prepared to bear potential losses. No portion of this blog is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Certain information contained in the individual blog posts will be derived from sources that Windward believes to be reliable; however, the Firm does not guarantee the accuracy or timeliness of such information and assumes no liability for any resulting damages.

Windward is an SEC registered investment adviser. The Firm may only provide services in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about Windward’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov.