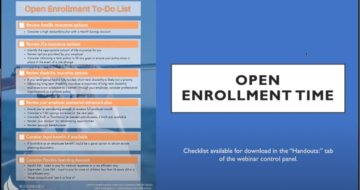

Have questions about enrolling for health insurance and other employer/employee benefits? Key Conversations: Options that may be available to employers/employees Health insurance options Health Savings Accounts (HSAs) Life & disability insurance options Dependent Care Flexible … [Read more...]

Recorded Webinar: Open Enrollment Time!

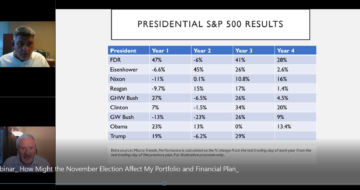

Recorded Webinar: How Might the November Election Affect My Portfolio and Financial Plan?

The November election will take place during a global pandemic, and a recessionary economy. What was discussed during this webinar: • Are there wealth management plan changes that should be considered now and in the coming months? • Are there tax planning moves I should consider? • Is it … [Read more...]

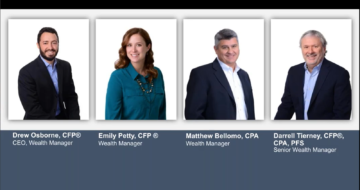

Recorded Webinar: Advisory Panel Discussion and Q&A

On June 11th the Windward Private Wealth Management advisors held an advisory panel discussion online. The first part of the webinar we discussed: Planning opportunities around Health Savings Accounts (HSAs) Tax saving strategies around home office planning and more Investment mistakes … [Read more...]

Advisory Panel Discussion and Q&A

Join us as the Windward Private Wealth Management advisors hold an advisory panel discussion online. Our discussion is open to any and all who can attend. Thursday June 11, 2020 at 2:00 PM (CST) Register for the webinar here. The first half of the webinar we will discuss: Planning … [Read more...]

Recorded Webinar: Should My Wealth Management Plan Change?

Thursday, April 30th the Windward Private Wealth Management advisors addressed common financial planning questions in today's reality. Covid-19 has changed the economy, the markets, tax law, portfolios and financial plans. What wealth management plan changes should you consider now and … [Read more...]