A rustic cabin. A seaside cottage. Buying a second/vacation home can be an alluring prospect. Before you decide to purchase one, though, you should consider a number of issues. These include the costs associated with owning a second/vacation home, the attributes of the home, its rental potential, … [Read more...]

Special Considerations for Second/Vacation Homes

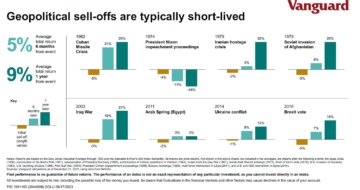

Ukraine and your portfolio

You may be asking yourself if the current market declines warrant a change in your portfolio. Should you modify your investment mix because of what’s going on in Russia and Ukraine? If things worsen, how will you defend your portfolio from further declines but also benefit when the market … [Read more...]

2022 Retirement Plan Limits

Generally, the amount that you can contribute to IRAs and retirement plans are indexed for inflation each year. In 2022, the contribution limit for IRAs is the same as it was for 2021. However, other key numbers have increased, like how much you can put in an employer-provided retirement plan. The … [Read more...]

6 Essential Tips in Choosing the Right Financial Advisor

A financial advisor will play a vital role in your life. As people who will be involved in your financial success, you need to choose someone you can trust. This is why it’s important to weigh your different options and gauge how helpful they will be in your situation. Here are six things you can do … [Read more...]

Five Keys to Investing for Retirement

Making decisions about your retirement account can seem overwhelming, especially if you feel unsure about your knowledge of investments. However, the following basic rules can help you make smarter choices regardless of whether you have some investing experience or are just getting started. 1. … [Read more...]