Employer-sponsored qualified retirement plans such as 401(k)s are some of the most powerful retirement savings tools available. If your employer offers such a plan and you're not participating in it, you should be. Once you're participating in a plan, try to take full advantage of it. Understand … [Read more...]

Taking Advantage of Employer-Sponsored Retirement Plans

Bear Market Video, Roth IRAs, Avett Brothers

A genius is the man who can do the average thing when everyone else around him is losing his mind. - Napoleon Bear Market Webinar On June 30th, Drew Osborne and Brandy Ward discussed thoughts and considerations about the stock market falling in to bear market territory and concerns the … [Read more...]

The Health of Social Security

Some Good News and Some Bad News With approximately 94% of American workers covered by Social Security and 65 million people currently receiving benefits, keeping Social Security healthy is a major concern.1 Social Security isn't in danger of going broke — it's financed primarily through payroll … [Read more...]

Thoughts on the Current Bear Market

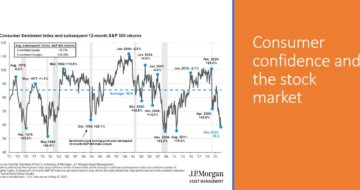

You may have recently heard about the stock market falling into bear market territory, and about concerns the economy could be heading into a recession. The stock market has had a rough first half of the year, with much of the gains from the past two years being lost in 2022. Thursday, June 30th … [Read more...]

Missouri Tax Credit

For Missouri taxpayers, a new tax credit is available for those who make eligible contributions to these certified educational assistance organizations. The program is called the Missouri Empowerment Scholarship Accounts Program, MOScholars, and it funds scholarship accounts for qualified Missouri … [Read more...]