Roth IRAs are popular retirement savings vehicles because distributions from them are tax-free. You can make a contribution to a Roth IRA if your income is below a certain level but another way to fund a Roth is to convert some or all of your IRA or retirement plan money to a Roth IRA. Contributing … [Read more...]

Roth Contributions and Conversions

The 411 on Health Savings Accounts

Most income tax benefits have symmetry. For example, if you defer income by contributing to a 401(k) plan, you are not taxed on the income that you contribute. Down the road when you distribute those funds out of your 401(k) plan, those distributions are taxable. Similarly, if your contributions are … [Read more...]

Where is my stimulus payment?

As the coronavirus (COVID-19) continues to affect our country and local communities, we want to provide some clarity to the tax-related provisions of the CARES Act. The "economic impact payments" for individuals have garnered the most interest and have received a great deal of media attention over … [Read more...]

Recorded Webinar: Open Enrollment Time!

Have questions about enrolling for health insurance and other employer/employee benefits? Key Conversations: Options that may be available to employers/employees Health insurance options Health Savings Accounts (HSAs) Life & disability insurance options Dependent Care Flexible … [Read more...]

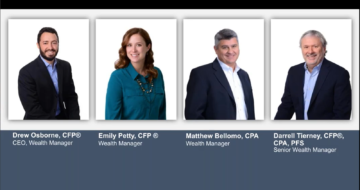

Recorded Webinar: Should My Wealth Management Plan Change?

Thursday, April 30th the Windward Private Wealth Management advisors addressed common financial planning questions in today's reality. Covid-19 has changed the economy, the markets, tax law, portfolios and financial plans. What wealth management plan changes should you consider now and … [Read more...]