Join us as the Windward Private Wealth Management advisors hold an advisory panel discussion online. Our discussion is open to any and all who can attend. Thursday June 11, 2020 at 2:00 PM (CST) Register for the webinar here. The first half of the webinar we will discuss: Planning … [Read more...]

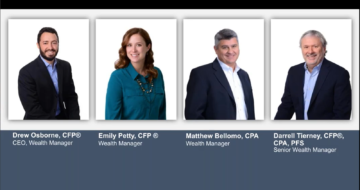

Advisory Panel Discussion and Q&A

Recorded Webinar: Should My Wealth Management Plan Change?

Thursday, April 30th the Windward Private Wealth Management advisors addressed common financial planning questions in today's reality. Covid-19 has changed the economy, the markets, tax law, portfolios and financial plans. What wealth management plan changes should you consider now and … [Read more...]

The Scoop on Recovery Rebates

You've probably heard that IRS will be making millions of "economic impact payments" (also called "recovery rebates") in the coming months to help people stay afloat during this time of economic uncertainty related to the COVID-19 crisis. Here's what you need to know about this program. Amount of … [Read more...]

Frequently Asked Questions: Asset Allocation

The financial markets continue to experience a great deal of volatility due to the yet unknown financial and economic impact of the COVID-19 pandemic. Additionally, Congress passed a $2 trillion stimulus package which includes a myriad of provisions aimed at mitigating the financial impact of the … [Read more...]

Updates: 2019 Taxes, Retirement Contributions, and CARES Act

As the coronavirus (COVID-19) continues to affect our country and local communities, we hope this note finds you and your families healthy and safe. Since our last email on March 20th, there have been significant tax changes enacted on both the Federal and state level. The Treasury Department and … [Read more...]