Modern capitalism is a pro at two things: generating wealth and generating envy. Perhaps they go hand in hand; wanting to surpass your peers can be the fuel of hard work. But life isn't any fun without a sense of enough. Happiness, as it's said, is just results minus expectations. - Morgan … [Read more...]

Health of Social Security, Retirement Contributions, Zephyr

Taking Advantage of Employer-Sponsored Retirement Plans

Employer-sponsored qualified retirement plans such as 401(k)s are some of the most powerful retirement savings tools available. If your employer offers such a plan and you're not participating in it, you should be. Once you're participating in a plan, try to take full advantage of it. Understand … [Read more...]

Bear Market Video, Roth IRAs, Avett Brothers

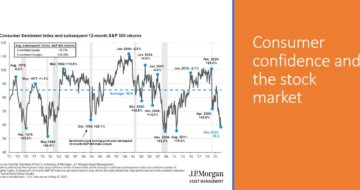

A genius is the man who can do the average thing when everyone else around him is losing his mind. - Napoleon Bear Market Webinar On June 30th, Drew Osborne and Brandy Ward discussed thoughts and considerations about the stock market falling in to bear market territory and concerns the … [Read more...]

The Health of Social Security

Some Good News and Some Bad News With approximately 94% of American workers covered by Social Security and 65 million people currently receiving benefits, keeping Social Security healthy is a major concern.1 Social Security isn't in danger of going broke — it's financed primarily through payroll … [Read more...]

Thoughts on the Current Bear Market

You may have recently heard about the stock market falling into bear market territory, and about concerns the economy could be heading into a recession. The stock market has had a rough first half of the year, with much of the gains from the past two years being lost in 2022. Thursday, June 30th … [Read more...]