Many people had their first experience with saving for the future as children when they received a U.S. savings bond as a gift. Savings bonds are issued by the U.S. Treasury Department. However, unlike Treasury bills, notes, and bonds, they are not traded on the open market, and are sold almost … [Read more...]

U.S. Savings Bonds

What Do Rising Interest Rates Mean for Your Money?

On May 4, 2022, the Federal Open Market Committee (FOMC) of the Federal Reserve raised the benchmark federal funds rate 0.50%. This is part of a series of increases that the FOMC expects to carry out over the next two years to combat high inflation.1 Along with announcing the current increase, … [Read more...]

Falling Bond Prices

The ups and downs of the bond market aren’t typically as dramatic as stock market fluctuations. However, this isn’t always the case, as we’ve seen so far in 2022. The Federal Open Market Committee has started raising the federal funds rate and plans to continue to raise it further, which has caused … [Read more...]

Contributing to Roth IRAs 2022

Roth IRAs are popular retirement savings accounts because distributions from them can be tax-free. You can make a contribution to a Roth IRA if your income is below a certain level. Another way to fund a Roth is to convert some or all of your IRA or retirement plan money to a Roth IRA. Contributing … [Read more...]

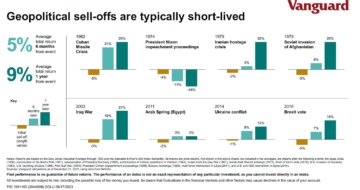

Ukraine and your portfolio

You may be asking yourself if the current market declines warrant a change in your portfolio. Should you modify your investment mix because of what’s going on in Russia and Ukraine? If things worsen, how will you defend your portfolio from further declines but also benefit when the market … [Read more...]