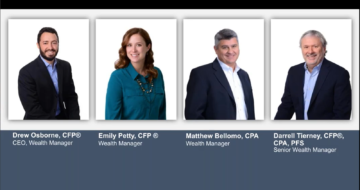

Thursday, April 30th the Windward Private Wealth Management advisors addressed common financial planning questions in today's reality. Covid-19 has changed the economy, the markets, tax law, portfolios and financial plans. What wealth management plan changes should you consider now and … [Read more...]

Recorded Webinar: Should My Wealth Management Plan Change?

The Scoop on Recovery Rebates

You've probably heard that IRS will be making millions of "economic impact payments" (also called "recovery rebates") in the coming months to help people stay afloat during this time of economic uncertainty related to the COVID-19 crisis. Here's what you need to know about this program. Amount of … [Read more...]

Frequently Asked Questions: Asset Allocation

The financial markets continue to experience a great deal of volatility due to the yet unknown financial and economic impact of the COVID-19 pandemic. Additionally, Congress passed a $2 trillion stimulus package which includes a myriad of provisions aimed at mitigating the financial impact of the … [Read more...]

Choosing a Beneficiary for Your IRA or 401(k)

**Please note: a previous version of this blog post should have noted that the ability to use your own life expectancy to calculate Required Minimum Distributions may not be available to certain beneficiaries under the SECURE Act. Selecting beneficiaries for retirement benefits is different from … [Read more...]

Perspective on Recent Stock Market Volatility

If you have been watching the news about the stock markets, you have likely noticed that volatility in the markets is rearing its ugly head. We know it’s difficult to watch your account balances fluctuate and we understand the anxiety. While turbulence is unsettling, we believe it's important to … [Read more...]