You may be asking yourself if the current market declines warrant a change in your portfolio. Should you modify your investment mix because of what’s going on in Russia and Ukraine? If things worsen, how will you defend your portfolio from further declines but also benefit when the market rebounds?

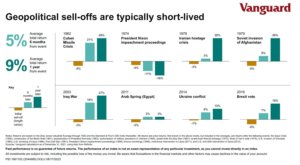

Vanguard offers interesting perspective on historical market sell-offs (declines) upon the initial news of major geopolitical events. Over the past six decades, they found that market declines in reaction to major geopolitical events have typically been short-lived. Vanguard looked at market returns in reaction to events such as the Cuban Missile Crisis, Nixon impeachment proceedings, assassination of President Kennedy, the Iranian hostage crisis, Iraq War, the First Gulf War, and more. The stock market’s total return averaged 5%, six months after the initial news of these events. If you go out one year from these events, the average total stock market return is 9%.

Big picture

Historically, equity markets have reacted negatively to the initial news of major geopolitical events but on average those declines were temporary. The declines we are currently experiencing may or may not be temporary. There are still a lot of unknowns. In the long run, we expect the markets to continue to grow and evolve. The best thing for your portfolio right now may be to do nothing and sit tight.

Having an investment plan that is customized to your financial goals, cash needs, time horizon and risk tolerance is important. An investment plan is a blueprint or map to follow in good markets and in bad. Reviewing your investment plan with your financial advisor can be helpful in alleviating concerns about current events’ impact on the markets. Making changes in your portfolio when the market is down can have a big (sometimes detrimental) impact.

If you are concerned about your portfolio and are looking for some guidance or want to schedule a review with your Windward wealth management team, send us a message.

Source

“Ukraine and the changing market environment”. Vanguard Perspective, Vanguard.com. 25 February 2022. https://advisors.vanguard.com/insights/article/ukraineandthechangingmarketenvironment?cmpgn=FAS:EM:NWLTR:948116273200

This content is provided by Windward Private Wealth Management Inc. (“Windward” or the “Firm”) for informational purposes only. Investing involves the risk of loss and investors should be prepared to bear potential losses. No portion of this blog is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Certain information contained in the individual blog posts will be derived from sources that Windward believes to be reliable; however, the Firm does not guarantee the accuracy or timeliness of such information and assumes no liability for any resulting damages.

Windward is an SEC registered investment adviser. The Firm may only provide services in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about Windward’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov.