Author: Brent Lemieux CFA® CPA

Portfolio Rebalancing Explained

At a high level, rebalancing is the process of adjusting your portfolio back to its target asset allocation percentages. Over time, investments change value and the allocation will drift away from the original target. In order to keep your portfolio aligned with your long-term goals, portfolio rebalancing is necessary.

For example, let’s use a hypothetical portfolio with an original target asset allocation of 50% equities and 50% bonds:

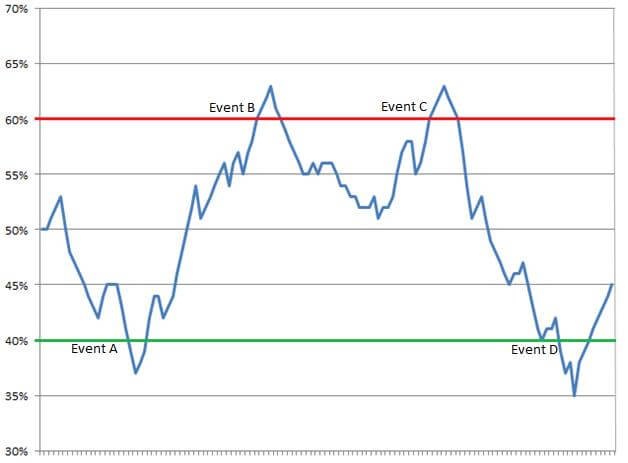

Stocks as a percentage of your portfolio

For this example, we’ve set rebalancing “bands” at 20%. This means that whenever stocks become more than 60% or less than 40% of the total portfolio, a rebalancing action is triggered. To rebalance the portfolio we would sell one asset class (in this example stocks or bonds) and buy the other to return the portfolio the target allocation. In the graph above, we would buy stocks and sell bonds at Event A, and do the opposite at Event B. Assuming that values revert to the mean using this methodology, we are “buying low and selling high”.

Why does it matter?

Rebalancing has many potential benefits, including:

- Providing investors with an objective portfolio management system. Emotions and investment decisions don’t mix. To avoid making behavioral mistakes, investors can follow a systematic rebalancing strategy to avoid doing the wrong thing at the wrong time.

- Controlling portfolio risk. If stocks increase dramatically as a percentage of your portfolio, your portfolio has increased in risk. Rebalancing controls the risk in your portfolio by taking gains from stocks “off the table” and transferring them to bonds. Bonds can fluctuate in value too, but high quality bonds are normally less volatile than stocks.

Additional considerations…

- Asset class target percentages. In order to execute a rebalancing strategy, it is necessary to determine target levels for each asset class (i.e. stocks, bonds, real estate).

- Band size. The band size is how far you will allow an asset class to drift away from its target before rebalancing. We believe band sizes should be large enough that excessive trading costs are avoided, but small enough that the portfolio doesn’t drift too far from the target allocation.

- How often are you checking your portfolio for rebalancing opportunities? At Windward, we monitor your portfolio for rebalancing weekly. Our motto is “look frequently, but trade infrequently”.

If you are interested in learning more about our approach to rebalancing and the entire wealth management process, please contact us today.

This blog is provided by Windward Private Wealth Management Inc. (“Windward” or the “Firm”) for informational purposes only. Investing involves the risk of loss and investors should be prepared to bear potential losses. No portion of this blog is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Certain information contained in the individual blog posts will be derived from sources that Windward believes to be reliable; however, the Firm does not guarantee the accuracy or timeliness of such information and assumes no liability for any resulting damages.

Windward is an SEC registered investment adviser. The Firm may only provide services in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about Windward’ registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov.